Surrogacy can often be the only option for couples who want to have children but are physically unable to do so on their own. While there are many success stories of new happy families and surrogates who are glad they had the opportunity to help out, complications in other surrogacy arrangements have led the surrogacy process as a whole to be called into question.

In one high-profile case in Australia, two couples who had been lifelong friends entered into a surrogacy arrangement. They were so close that the couple who was unable to have children were the godparents for the children of the other couple. The mother who was unable to have children suffered from a heart condition that made pregnancy too risky and had been considering finding a surrogate overseas. When her friend learned of this, she wouldn’t have it and insisted on acting as the surrogate.

The two couples completed the usual medical and background checks, and everything appeared to be going well after the surrogate underwent in vitro fertilization. Trouble arose later in the pregnancy when the surrogate was no longer able to complete everyday tasks. She felt like her friends weren’t helping her enough with household chores she couldn’t complete on her own, with caring for her own kids, and with various expenses like maternity close. The disputes continued into the delivery room when the couples couldn’t even agree on how to announce the birth or what photos should be taken.

Eventually, the surrogate was reimbursed for most of her expenses, but she later became outspoken in favor of commercial surrogacy, calling it the only way to ensure that the surrogate was protected.

Commercial surrogacy has been widely criticized as being almost like another form of prostitution. The fear is that poor women, especially from developing countries, will be exploited by richer couples who are unable to have children of their own.

While surrogacy may be controversial, it is similar to other debates about freedom of choice and how much protection people need. In any system without regulation, there is a risk that people will be so concerned with their own gain that they disregard potential harm to others and disputes may be difficult to regulate without a proper framework in place.

This doesn’t mean that surrogacy should be avoided just because certain aspects of it may be debatable. As it grows in popularity, governments are increasingly passing regulations to try to avoid repeats of prior complications. Australia has banned commercial surrogacy as a way to prevent exploitation, and they are continuing to put regulations in place to protect the health of all those involved in the process.

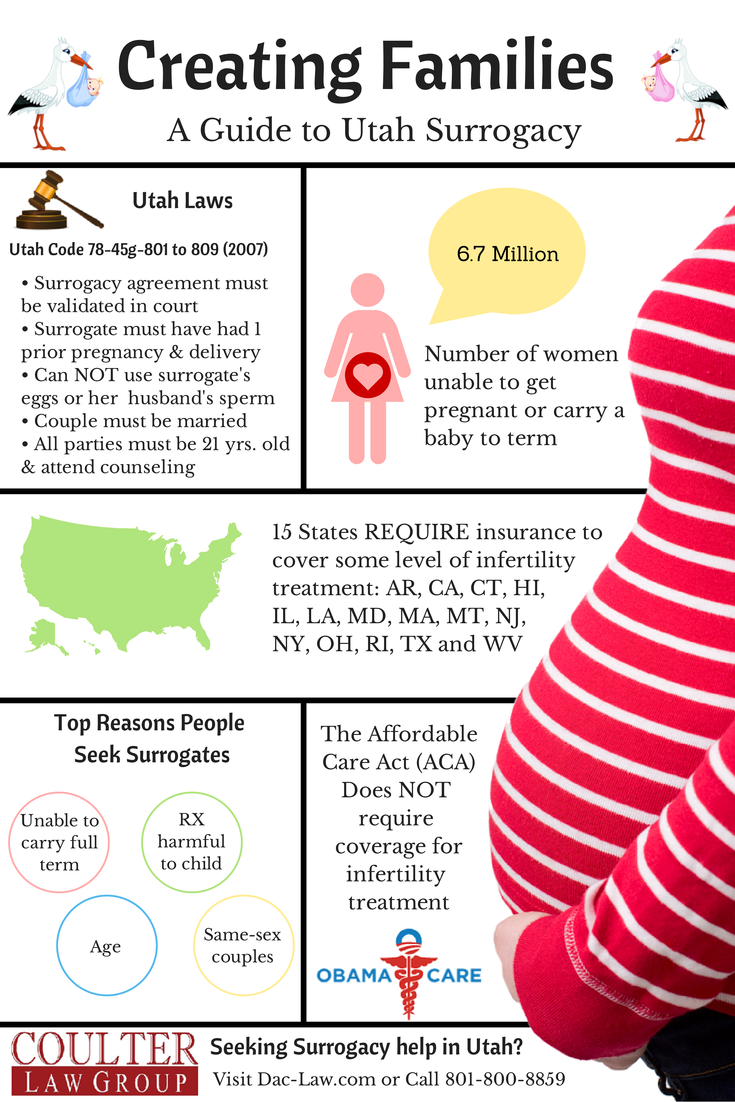

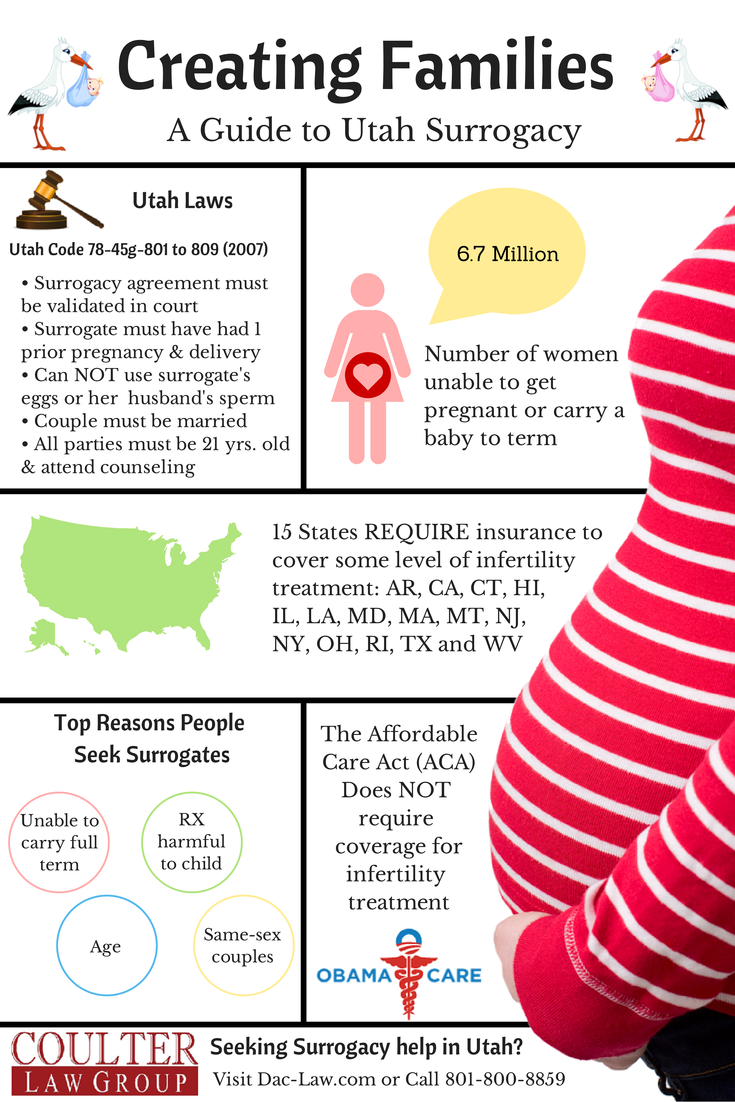

Surrogacy Laws in Utah

In the United States there are no federal regulations regarding surrogacy arrangements. Laws are passed at the state level and vary greatly state to state.

Utah’s surrogacy laws were based on this model act and can be found in Utah Code Ann. §§ 78-45g-801 to 809. The law outlines requirements for both the surrogate and intended mother to be able to enter into a surrogacy arrangement.

Requirements for the Utah surrogate:

- Must have had at least one prior pregnancy and delivery

- May not use her own eggs

- May not use her husband’s sperm

- Must be age 21 or older

- Must participate in counseling

- Must have been a Utah resident for at least 90 days prior to entering into the agreement

- Cannot be receiving Medicaid or other state assistance at the time of the agreement

Requirements for the intended mother:

- Must show that she is unable to carry a pregnancy or give birth

- At least one of her or her husband must provide gametes

- Must be age 21 or older

- Must participate in counseling

- Must have been a Utah resident for at least 90 days prior to entering into the agreement

Establishing a Surrogacy Agreement in Utah

In Utah, a surrogacy agreement is legally binding as long as the legal requirements have been met. Unlike in other jurisdictions, the surrogate cannot later decide to keep the child for herself. The primary requirement is that the agreement be validated in court. This allows the court to ensure that the requirements for a surrogacy arrangement have been met. An agreement that has not been validated is not enforceable, and parental rights and obligations will be determined under Utah’s Uniform Parentage Act. The Uniform Parentage Act was a model law initially passed in 1973 to give legitimacy to children not born to a married mother and father. Subsequent amendments added provisions for identifying the legal parents in surrogacy arrangements and other special circumstances.

A Utah Surrogacy agreement may provide for compensation to the surrogate, but it must be reasonable. This might include things like out of pocket expenses, someone to help the surrogate around the house late in pregnancy, and possibly compensation for unpaid time off from work. A “for-profit” type of arrangement would not be approved.

While the intended parents have full parental rights after birth, the surrogate has full control over her healthcare decisions during the pregnancy. This may include, if medically necessary, the decision whether to terminate the pregnancy.

One important note is that Utah’s requirement that the intended parents be married limits surrogacy agreements to heterosexual couples. While there is no explicit ban under the surrogacy laws, state law does not permit same-sex marriage, and thus a homosexual couple cannot meet the marriage requirements. Utah courts have previously ruled against equal parental rights for homosexual couples.

Cost of Surrogacy

Surrogacy can take two forms. Traditional surrogacy is where the surrogate’s own egg is inseminated, and gestational surrogacy is where a woman is implanted with an embryo that does not use her own eggs. Because Utah does not allow the surrogate to use her own eggs, it forces couples to use gestational surrogacy. Since this method requires medical treatment for two women instead of one, the costs can be as much as $13,000 — about 1.5 times the cost of in vitro fertilization.

Uncovered Areas

Although it may seem like Utah’s surrogacy laws are well-developed, they are still relatively new and don’t cover every possible circumstance. Most notably, the law allows a surrogate to terminate the agreement by providing written notice before she becomes pregnant without being liable. In at least two instances, this happened after the intended parents had spent thousands of dollars in counseling and other preparation costs and also cost them lost time and emotional distress. Other grey areas include who has parental rights if one or both of the intended parents die during the process, who makes medical decisions if health problems in the baby are detected prior to birth, and what happens if a court invalidates a surrogacy agreement based on previously unknown information.

Why Utah Parents Choose Surrogacy

Despite the potential complications, many parents still opt for surrogacy, and it may often be their only option for having children. Even though adoption may be available, the child would not be genetically related to them. Reasons for choosing surrogacy include failed attempts at in vitro fertilization, abnormal or absent uterus, repeated miscarriages, and health conditions that would make carrying a pregancy or giving birth dangerous.

And for every horror story that winds up in the courts, there are dozens of other positive outcomes. One Australian girl learned when she was 15 that she was born without a womb and would be unable to have a child of her own. Her sister promised her that when the time came, she would carry a child for her. When the time did come, with both sisters happily married, they did just that and received both psychological and legal counseling along with their husbands to make sure the process would go smoothly. Everything did go according to plan, and after the baby was born, the sisters said that they felt closer to each other than ever before.

How to Protect Yourself While Using a Surrogate Mother

As you’ve probably seen, surrogacy is the most legally complicated assisted reproduction option. This simply comes from the number of parties involved and the length of the arrangement. Rather than an anonymous donor or a child who is already born, the parties will be involved in the process from long before conception until after birth. Because of all of the conflicting rights and possible complications, surrogacy isn’t just something you can jump into, and simply relying on the established laws won’t fully protect your rights.

No matter how close the surrogate and intended parents are, it’s important to seek the advice of a Utah surrogacy attorney prior to entering into a surrogacy agreement. The goal isn’t to be prepared to fight each other in court but to make sure conflicts are prevented to begin with. Discussing each aspect of the surrogacy process will make sure the parties are truly in agreement about all issues and aren’t making assumptions that will lead to turmoil when they find out that they actually have a strong disagreement. It will also keep smaller disputes about things like who pays for what expenses from souring the relationship.

If you’re in Utah, contact Coulter Law Group. We specialize in reproductive law and will make sure your rights are covered no matter what happens during the surrogacy process.

A Limited Partnership (“LP”) is comprised of one or more general partners and one or more limited partners. LPs are creatures of statute – you must file a form with the state to bring one into being. A LP exists apart from its creators as a distinct legal entity. This means it can sue, be sued, and own property on its own. General partners are in charge of daily operations and are still personally liable for the company’s obligations and debts. The limited partners invest capital in the company and share in the profits, but take no part in the daily operations. A LP protects limited partners from personal liability; liability is restricted to the amount of capital the limited partner has decided to invest. LPs distribute funds among different shareholders as “dividends”.

A Limited Partnership (“LP”) is comprised of one or more general partners and one or more limited partners. LPs are creatures of statute – you must file a form with the state to bring one into being. A LP exists apart from its creators as a distinct legal entity. This means it can sue, be sued, and own property on its own. General partners are in charge of daily operations and are still personally liable for the company’s obligations and debts. The limited partners invest capital in the company and share in the profits, but take no part in the daily operations. A LP protects limited partners from personal liability; liability is restricted to the amount of capital the limited partner has decided to invest. LPs distribute funds among different shareholders as “dividends”. TruGreen Salt Lake

TruGreen Salt Lake A

A  REFS-The Real Estate and Foreclosure Specialists

REFS-The Real Estate and Foreclosure Specialists You

You  Larry H. Miller Group of Companies

Larry H. Miller Group of Companies Nonprofit organizations are formed in the state where they intend to do business. Unlike a standard corporation, nonprofits do not conduct activities for the financial gain of shareholders. Preventing the distribution of profits to members/shareholders is what distinguishes the nonprofit from a commercial enterprise; yet nonprofits still provide asset protection and limited liability. A nonprofit corporation is not forbidden from making a profit — but if it does, that profit can only be used to further the overarching goal or mission of the organization. Nonprofits can also trade at a profit and accept, hold and disburse money; but all profit and things of value are to be used to further the nonprofit’s quest. Nonprofits are organized in many different ways: charities, service organizations, trusts, hospitals, universities, foundations, endowments and cooperatives can all operate as nonprofits. Nonprofits can have “members”, although many do not. They may have employees, and can compensate their directors reasonably, but only if compensation is documented ever-so-carefully.

Nonprofit organizations are formed in the state where they intend to do business. Unlike a standard corporation, nonprofits do not conduct activities for the financial gain of shareholders. Preventing the distribution of profits to members/shareholders is what distinguishes the nonprofit from a commercial enterprise; yet nonprofits still provide asset protection and limited liability. A nonprofit corporation is not forbidden from making a profit — but if it does, that profit can only be used to further the overarching goal or mission of the organization. Nonprofits can also trade at a profit and accept, hold and disburse money; but all profit and things of value are to be used to further the nonprofit’s quest. Nonprofits are organized in many different ways: charities, service organizations, trusts, hospitals, universities, foundations, endowments and cooperatives can all operate as nonprofits. Nonprofits can have “members”, although many do not. They may have employees, and can compensate their directors reasonably, but only if compensation is documented ever-so-carefully. IHC (Intermountain Health Care)

IHC (Intermountain Health Care) A partnership consists of more than one business owner; it comes into being whenever business takes place between parties, making them “partners”. A “partner” does not need to be an individual. Partners can be corporations, trusts, or other partnerships. Partners take on profits, losses and liabilities together, and will generally

A partnership consists of more than one business owner; it comes into being whenever business takes place between parties, making them “partners”. A “partner” does not need to be an individual. Partners can be corporations, trusts, or other partnerships. Partners take on profits, losses and liabilities together, and will generally  Congress has clarified that all corporations are divided into two groups: S Corporations that fall under IRS revenue code subchapter S; and C Corporations, which encompass all other corporations. Your first step in creating an S Corporation (“S Corp”) is to form a traditional corporation. Next, you must file a special form (form 2553) with the IRS, along with any other local state documentation. S Corp status is effective for a tax year if form 2553 is filed: (a) any time during the previous tax year, or (b) by the 15th day of the 3rdmonth of the tax year to which the election is to apply. An

Congress has clarified that all corporations are divided into two groups: S Corporations that fall under IRS revenue code subchapter S; and C Corporations, which encompass all other corporations. Your first step in creating an S Corporation (“S Corp”) is to form a traditional corporation. Next, you must file a special form (form 2553) with the IRS, along with any other local state documentation. S Corp status is effective for a tax year if form 2553 is filed: (a) any time during the previous tax year, or (b) by the 15th day of the 3rdmonth of the tax year to which the election is to apply. An